The United States’ population of ultra-high-net-worth individuals grew by 6 percent overall last year, and no states saw a decrease in this demographic, according to findings by Wealth-X.

Wealth-X’s “American Ultra Wealth Ranking 2014-2015” found that the UHNW population of the U.S. is primarily concentrated in major metropolitan areas across the country, while some states boast more than one city with a large demographic of wealth. Having access to this information can help brands and retailers determine the best areas in the U.S. to expand or fine-tune their retail footprint to better serve this discerning consumer segment.

“Using this UHNW wealth intelligence data, [marketers] should be performing a retail portfolio gap analysis that looks at where their wealthiest clients are located, where they retail portfolio is located and where the clusters of UHNW wealth are both currently and in the future going to be developing,” said David Friedman, president of Wealth-X, New York.

“This juxtaposition of key strategic geo-wealth clustering will provide them with a current assessment of their locations and a gap analysis of where they should be skating, not where the puck is today (to quote a famous hockey player),” he said.

The American Ultra Wealth Ranking 2014-2015 showcases Wealth-X’s intelligence on the ultra-wealthy by state. The report gives insight into the United States’ ultra wealthy population, defined as those with net assets of $30 million and above.

Land of the free, and wealthy

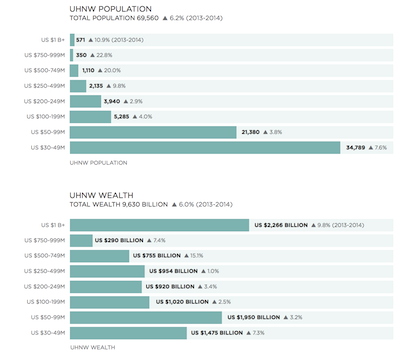

Overall, the U.S. is home to 69,560 UHNW individuals, more than any other country in the world. When compared to the entirety of the UHNW global population, those from the U.S. account for a third of the population.

UHNW individuals in the U.S. are worth more than $500 million, and grew faster than all other wealth tiers in terms of population size and wealth.

“They have received some lift form the equity growth over the past several years, but since most of their wealth is tied up in privately held and family controlled businesses, that part of their wealth is also experiencing growth since the increase in liquidity and profits from corporations is giving them large war chests for potential acquisitions which drives up values in the private market,” Mr. Friedman said.

As for millionaires, the U.S. is home to more individuals worth $30 million to $49 million than all the wealth tiers in any other country. The U.S. is also home to the largest population of billionaires while 2,031 individuals are worth a combined $3.3 trillion.

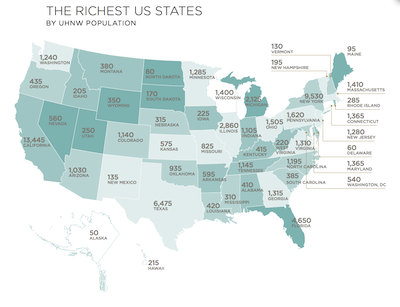

These UHNW individuals are spread primarily among 13 of the country’s top tier cities, with populations of more than 1,000 individuals. On a global scale, 35 of the 100 top cities, in terms of UHNW population size, are within the U.S. as well.

Wealth-X infographic of UHNW wealth in the U.S.

Overall, 65 percent of the U.S. UHNW population resides in 30 cities such as New York, San Francisco, Los Angeles, Chicago and Washington being in the top 5. To put the percentages in a global context, Charlotte, NC is ranked 30th on the list, but its UHNW population is larger than that of a number of Middle Eastern countries such as Israel, Lebanon, Qatar and Bahrain.

Interestingly, only four out of the country’s 50 states have more than one city with a large population of UHNW citizens. These being, California, Texas, Florida and Missouri.

California is home to 13,445 UHNW individuals, making it the state with the largest population of wealthy citizens. The state also boasts five cities on the top 30 list with San Francisco and Los Angeles accounting for 79 percent of the state’s entire UHNW population.

From the year-ago, California’s ultra-high-net-worth population has grown by 5 percent, due largely in part by its technology and biotechnology businesses.

New York’s ultra-high-net-worth also grew in 2014 and has the largest wealthy population of any metropolitan city in the world, but it’s only home to 12 percent of the U.S. ultra-affluents.

Wealth-X infographic of UHNW wealth in the U.S.

In 2014, Florida also saw an increase of ultra-high-net-worth individuals in its state. The population grew by 10.3 percent, adding 435 new UHNW individuals due to strong growth in its financial and real estate sectors.

Miami in particular has seen growth in terms of residential homes and retail real estate. In 2014 luxury real estate witnessed its slowest quarter of growth since 2012, according to a report on luxury home prices from Redfin Research Center.

With a 16 percent incline in the first three months of 2014, real estate officials were anticipating a continual trend, but the market dropped off in the later months of the year with a 3 percent growth rate in the fourth quarter. Looking into real estate trends in specific towns and cities across America can give luxury brands insight into the locations with target consumer audiences (see story).

You betcha

Interestingly, North Dakota saw a population increase of 14.3 percent in 2014, the sharpest of any state for the year. Likewise, South Dakota’s UHNW population swelled by 13.3 percent, the second largest increase among U.S. states.

In North Dakota, for example, there was a 14.3 percent increase in the UHNW population, making the northern state the fastest growing among this sector of individuals. Its neighboring state, South Dakota, also saw an increase in its UHNW population as some local businesses saw profitable numbers that allowed certain individuals to cross over the $30 million threshold (see story).

For many marketers, North and South Dakota are not likely on their retail radars since the states are not commonly associated with traditional luxury.

“It’s always interesting to see where cities and states rank,” Mr. Friedman said. “I think people are always surprised by the fact that Chicago is ahead of places like Texas or that Chicago is ranked 4th in the U.S. and 9th in the world.

“Also, on the state ranking, probably underscores the notion of that most of this UHNW wealth is privately held and illustrated by the fact that Ohio is ranked number 8,” he said.

Source: Luxury Daily